India’s financial ecosystem is at the cusp of a transformative era thanks to the rise of Open Banking. With rapid advancements in digital infrastructure and a thriving fintech scene, the conversation is no longer just about sharing data; it’s about what we build next. Open Banking has redefined how consumers and businesses interact with financial services from real-time credit decisions to UPI payments making experiences more seamless, intelligent, and inclusive.

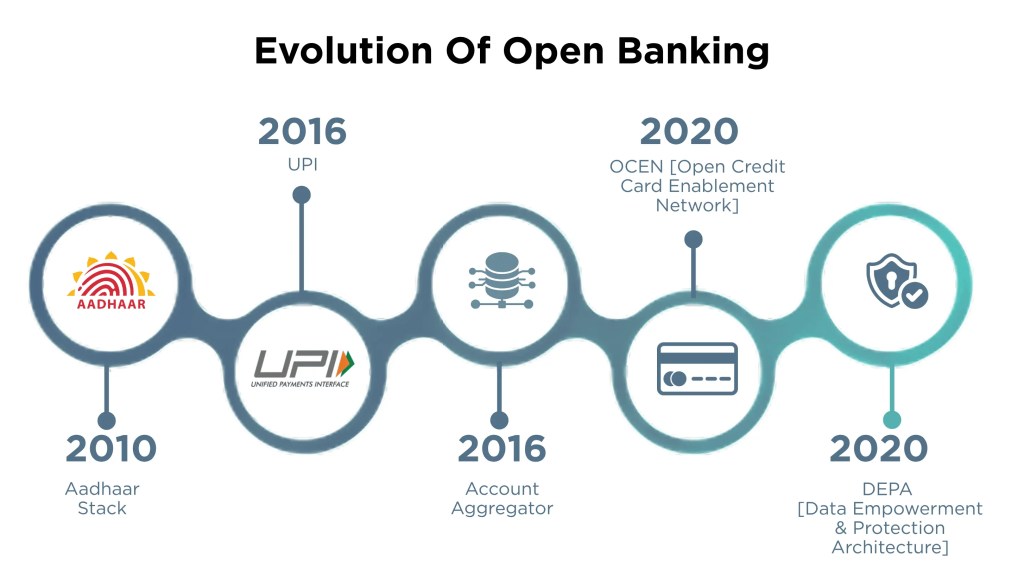

How Open Banking in India Has Evolved Over the Years

Over the last few years, India has laid a strong foundation for Open Banking through a unique combination of:

The Account Aggregator (AA) framework which enables secure, consent-driven sharing of financial data across banks and fintechs to assess their credibility and capacity.

The broader India Stack and Digital Public Infrastructure (DPI), including Aadhaar, e-KYC, Digi Locker, and UPI, which make digital onboarding and transactions frictionless, while ensuring data security of both personal and financial data.

The RBI’s Regulatory Sandbox, which has fostered innovation through live testing of new financial products, services, and technologies in a controlled environment with regulatory relaxations, promoting experimentation and financial inclusion.

Open Banking in India: Market Size, Growth & Key Stats

- The India open banking market generated a revenue of USD 1,595.4 million in 2024 and is expected to reach USD 7,485.0 million by 2030, expected to grow at a CAGR of 31.8% from 2025 to 2030.

- In terms of segment, banking & capital markets were the largest revenue-generating services in 2024.

- Payments is the most lucrative services segment, registering the fastest growth during the forecast period.

Emerging Opportunities

Open Banking is unlocking a wave of new opportunities—enabling hyper-personalized financial products, smarter credit underwriting, and seamless embedded finance. It allows banks, fintechs, and even non-financial platforms to innovate faster, expand reach, and deliver context-aware services tailored to real-time user needs.

A Catalyst for Bank-Fintech Innovation

Open APIs are unlocking the ability to embed financial services seamlessly into non-financial platforms. As more banks adopt this approach, it opens significant opportunities for product innovation, new service models, and revenue growth. For instance, an e-commerce platform can directly offer instant BNPL or working capital loans using transaction data—eliminating the need to redirect users to a traditional banking interface.

Hyper-Personalisation of Service

Non-financial platforms (e.g., logistics, agri-marketplaces, gig work apps) can embed micro-insurance, real-time credit, or savings tools directly within user journeys—enabled by real-time data exchange and consent flows.

Enhanced SME Financing

Small businesses can unlock access to tailored credit lines and automated cash flow management tools. Open Banking allows lenders to underwrite loans using real-time bank transaction data, improving speed and accuracy.

Addressing the Challenges

Open banking faces key challenges, such as data privacy concerns, inconsistent API standards, and cybersecurity risks. Many banks are also hesitant to share data due to competitive pressures, which along with the recently introduced DPDPA Bill, challenge the ecosystem to evolve.

Building Consumer Trust with DPDPA incoming: Strong consent protocols and data privacy mechanisms, made transparent and understandable to the end user.

Ensuring Interoperability: Not all financial institutions are tech-ready. Harmonising API standards and encouraging ecosystem participation will be crucial in ensuring uniformity of service.

Regulatory Clarity: While the government has defined rules around consent. Regulators also need to provide clarity around the use of alternate data as Open Banking scales.

What’s on the Horizon?

Open Banking began as a way of giving third parties API-based access to banking data, empowering consumers and enabling tailored financial services. Today, it’s evolving into a broader ecosystem, driving intelligent, embedded, and cross-sector financial experiences, moving into the domain of Open Finance.

Broader Ecosystem Participation A wider range of financial and non-financial institutions including insurers, pension providers, wealth platforms, and even agri-tech or telecom players will integrate into Open Banking networks, driving cross-sector value creation.

Platform Banking Platform banking envisions banks as platforms that provide various services, including financial and non-financial services. For example, a bank platform providing home mortgages, stock broking, insurance, etc., in one place without the customer leaving the platform.

AI-Driven Financial Innovation: Expect a new generation of smart, adaptive products built at the intersection of Open Banking, AI, and real-time analytics, empowering organisations to predict customer needs and enhance service delivery.

Charting the Path Ahead

Open Banking is no longer just a technological initiative it’s a national infrastructure play that’s reshaping the very foundation of financial engagement. The next chapter lies in how we scale innovation responsibly, with trust, interoperability, and inclusion at the core. As stakeholders across the board banks, fintechs, regulators, and users come together, India is well-positioned to lead the next global benchmark in Open Finance.

Numerous financial institutions are re-evaluating their consent management and data governance strategies to help set themselves on the compliance path for DPDPA. DPDPA should not only be treated as a compliance requirement but also a strategic opportunity. Institutions that prioritize transparent, user-first consent systems will differentiate themselves and stay resilient. Let’s not wait for the final rulebook. Now is the time to set the base requirements in motion.